China cryptocurrency

With the US 2022 midterm elections still in the balance, economic issues have dominated recent discussions and anticipated voting behaviour. Against this backdrop, a national survey found there’s a new topic concerning the economy that is becoming increasingly salient with the electorate: cryptocurrency.< https://lamusuofficial.com/ /p>

Millions of consumers and businesses lost money, and perhaps more damaging for a nascent industry and technology, the fundamental trust in the promise of crypto-finance, which was supposed to be a correction to many of the misdeeds that gave rise to the 2008 financial crisis, is waning.

Ultimately, these results reveal that there is clear, broad bipartisan support for greater action in Washington to clarify and strengthen cryptocurrency rules and regulations, representing a rare opportunity for bipartisan efforts to succeed. The US has always been a leader in the global financial system, and its slow response to cryptocurrencies has threatened that position. While this poll is focused on Americans, there are broader takeaways here that policy-makers around the world should note: Crypto is here to stay, and is a topic that’s increasingly top of mind for future generations. The takeaways from this survey are a call to action to jurisdictions around the world. Governments need to act expeditiously to determine ways to support the continued growth of the crypto industry, while simultaneously protecting their citizens’ financial futures.

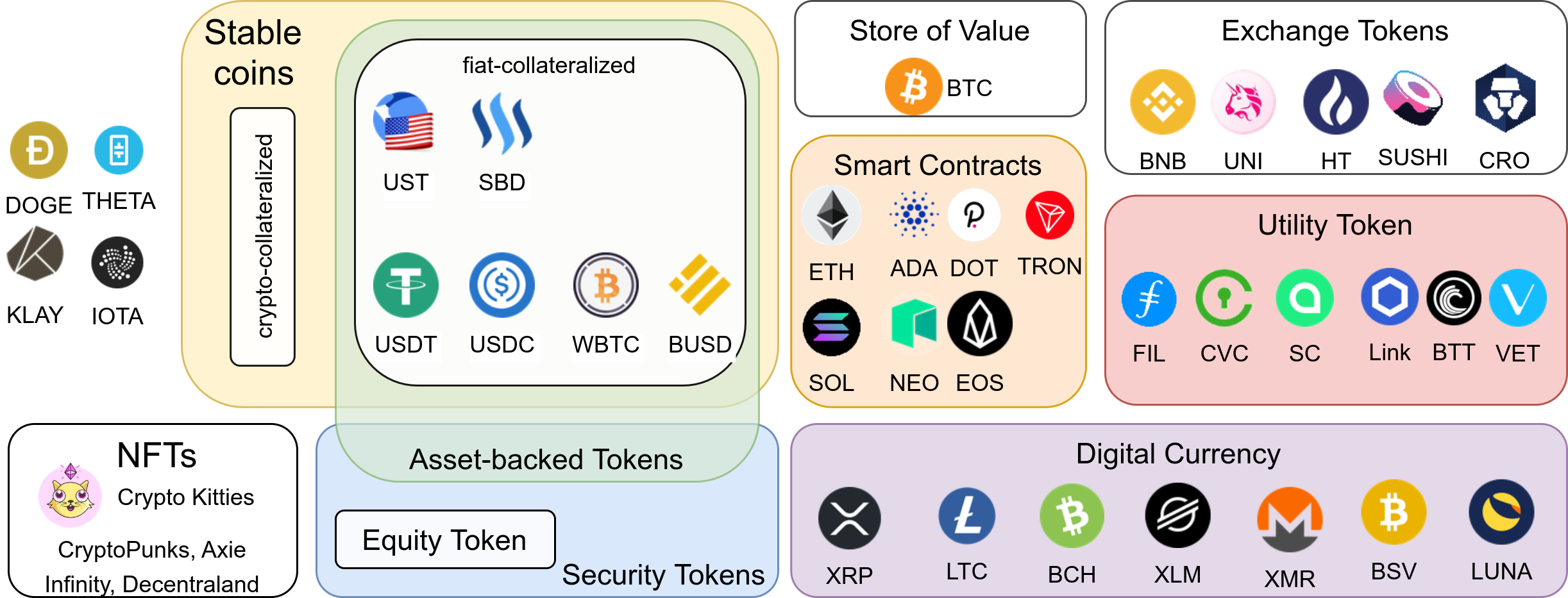

Types of cryptocurrency

The nodes are rewarded for verifying transactions — they’re rewarded with new Bitcoin. This is how new Bitcoins are created. You can compare it to gold mining, in which the miners are rewarded with gold. In Bitcoin mining, the nodes are the miners — they mine for new Bitcoin.

For instance, the Bitcoin network will typically share the addresses of the sender and the receiver, the amount transacted, and the fee paid. Additionally, a wallet’s entire transaction history is available on the internet.

Reeve Collins, Craig Sellars, and Brock Pierce founded Tether, a project initially called realcoin, in 2014. Tether is a stablecoin or cryptocurrency that pegs its value to an external fiat currency. For example, Tether is pegged to the value of the U.S. dollar at a 1:1 ratio. Tether also supports the euro (EUR), Mexican Peso (MXN), and offshore Chinese yuan (YNH). Like other digital currencies, Tether can move across blockchain networks, but it theoretically offers more pricing stability given its 1:1 peg to a government-issued currency. Tether couples the innovative nature of blockchain with the stability of fiat currencies to reduce volatility.

Cryptocurrency has sparked a global financial revolution, creating entirely new ways to shop, save and spend. Depending where you are in your crypto journey, you may have never delved much deeper than Bitcoin or Ethereum. But there’s a wide universe of cryptocurrencies out there beyond the most popular coins. Having so much to explore can feel intimidating, so let this post serve as your guided tour through the crypto landscape. Grab your safari hat, and read on for a detailed overview of the different types of cryptocurrency, their unique features and purposes and the innovative blockchain technology that underpins them.

Bitcoin is an independent protocol not interoperable with, say, Ethereum. However, with WBTC, BTC holders can use ‘their’ Bitcoins on the Ethereum network. The same also applies to the Tron network, whose community has created a WBTC version based on the TRC-20 token standard.

Cryptocurrency meaning

Individual coin ownership records are stored in a digital ledger, which is a computerized database using strong cryptography to secure transaction records, control the creation of additional coins, and verify the transfer of coin ownership. Despite the term that has come to describe many of the fungible blockchain tokens that have been created, cryptocurrencies are not considered to be currencies in the traditional sense, and varying legal treatments have been applied to them in various jurisdicitons, including classification as commodities, securities, and currencies. Cryptocurrencies are generally viewed as a distinct asset class in practice. Some crypto schemes use validators to maintain the cryptocurrency.

At present, India neither prohibits nor allows investment in the cryptocurrency market. In 2020, the Supreme Court of India had lifted the ban on cryptocurrency, which was imposed by the Reserve Bank of India. Since then, an investment in cryptocurrency is considered legitimate, though there is still ambiguity about the issues regarding the extent and payment of tax on the income accrued thereupon and also its regulatory regime. But it is being contemplated that the Indian Parliament will soon pass a specific law to either ban or regulate the cryptocurrency market in India. Expressing his public policy opinion on the Indian cryptocurrency market to a well-known online publication, a leading public policy lawyer and Vice President of SAARCLAW (South Asian Association for Regional Co-operation in Law) Hemant Batra has said that the “cryptocurrency market has now become very big with involvement of billions of dollars in the market hence, it is now unattainable and irreconcilable for the government to completely ban all sorts of cryptocurrency and its trading and investment”. He mooted regulating the cryptocurrency market rather than completely banning it. He favoured following IMF and FATF guidelines in this regard.

Systems of anonymity that most cryptocurrencies offer can also serve as a simpler means to launder money. Rather than laundering money through an intricate net of financial actors and offshore bank accounts, laundering money through altcoins can be achieved through anonymous transactions.

With more people entering the world of virtual currency, generating hashes for validation has become more complex over time, forcing miners to invest increasingly large sums of money to improve computing performance. Consequently, the reward for finding a hash has diminished and often does not justify the investment in equipment and cooling facilities (to mitigate the heat the equipment produces) and the electricity required to run them. Popular regions for mining include those with inexpensive electricity, a cold climate, and jurisdictions with clear and conducive regulations. By July 2019, bitcoin’s electricity consumption was estimated to be approximately 7 gigawatts, around 0.2% of the global total, or equivalent to the energy consumed nationally by Switzerland.

Bitcoin was the first of the many cryptocurrencies that exist today. Following its introduction in 2009, developers began to create other variants of cryptocurrencies based on the technology powering the Bitcoin network. In most cases, the cryptocurrencies were designed to improve upon the standards set by Bitcoin. That is why other cryptocurrencies that came after bitcoin are collectively called “altcoins” from the phrase “alternatives to bitcoin.” Prominent examples are:

This is what makes blockchain transactions secure and nearly impossible to alter. Tens of thousands of computers must verify a single transaction or entry. If there’s a disagreement among computers, the transaction will be voided.